#NaijaLiveTv

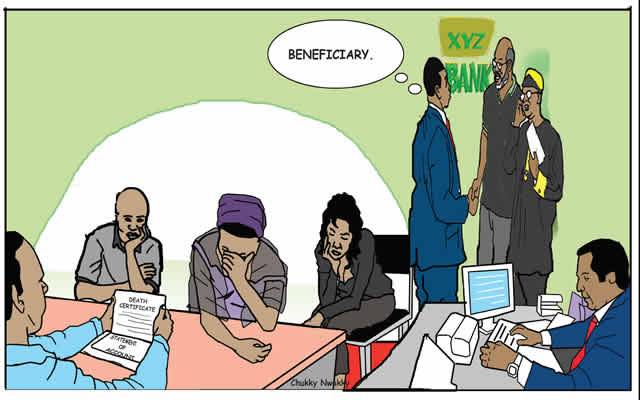

A beneficiary is somebody who receives assets at your death. With some types of accounts, you are allowed to designate who that person (or entity) is. This is an important decision because your beneficiary instructions can be separate from any last wishes you express verbally – or even in your will.

Beneficiaries are generally only available for certain types of accounts, according to www.thebalance.com.

Why have a beneficiary?

Whether or not you choose a beneficiary is a personal decision. Explore all of the options with your financial planner and an estate planning attorney.

Clarity: by assigning a beneficiary, you make it clear who should receive your assets in the event of your death. This eliminates any questions or disputes among remaining family members and friends who might contend that the deceased would have wanted somebody else to receive the assets.

Speed: choosing a beneficiary also speeds things up for the chosen beneficiary – it is often faster and easier to claim assets as a designated beneficiary. There is no need to wait for probate processes (which could take months or longer and require waiting for other assets to be dealt with). Instead, a named beneficiary can typically claim assets as soon as the decedent’s death is documented, usually by providing documents such as a death certificate and affidavit of domicile.

Moreover, a beneficiary designation usually supersedes (or overpowers) the instructions in a will – so the will only applies to assets that do not have a named beneficiary.

Types of beneficiaries

There are two basic types of beneficiaries:

*Primary beneficiaries

*Contingent beneficiaries

Primary beneficiaries are the account owner’s first choice for a beneficiary.

In the event of death, the first person who can claim the assets is the primary beneficiary. Note that you can have multiple primary beneficiaries in some cases. For example, you could have three primary beneficiaries, all of which receive 33.3% of assets (assuming they are all still living at the time of your death).

Contingent beneficiaries are used as a backup. In the event that there are no living primary beneficiaries, the contingent beneficiary claims the asset. A common example is this:

An account owner picks his wife as the primary beneficiary. She would receive all assets at his death. However, the husband and wife are killed together (at the same time) in an auto accident. Therefore, there is no living primary beneficiary. As a result, assets will go to a contingent beneficiary (if any).

The law dictates how assets are handled when there is no contingent beneficiary, or when none of the contingent beneficiaries claim the assets.

Within those two basic categories, there are other choices that can be made (again, speak with a local attorney and financial planner before making any decisions). You can name individual beneficiaries, or you can use other methods, including:

Naming an organisation or entity a… Read more

To Advertise or Publish a Story on NaijaLiveTv:

Kindly contact us @ Naijalivetv@gmail.com

Call or Whatsapp: 07035262029, 07016666694, 08129340000