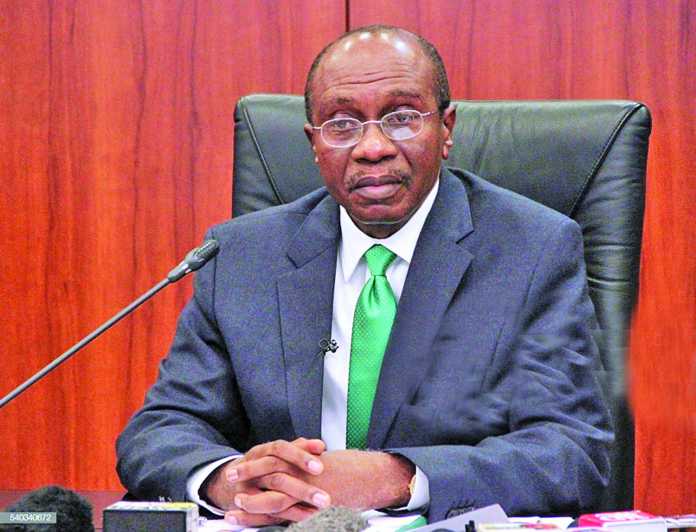

Governor of the Central Bank of Nigeria (CBN), Mr Godwin Emefiele, has said the likelihood of the apex bank devaluing the Naira is on the happenstance that the nation’s external reserves go below $30 billion and the international price of crude oil drops to $45 per barrel.

Mr Emefiele, according to a CBN publication, made this disclosure while speaking with potential investors in London, United Kingdom, on Wednesday.

The CBN chief was confident that the reserves were unlikely to drop to $30 billion due to the various policies put in place by the federal government as part of its plans to diversify the Nigerian economy.

Due largely to the tension between the United States and China, oil demand has been affected, leading to lower prices. However, the CBN boss noted that oil prices would need to weaken to 40 percent to create a scenario that would see that the bank not being able to maintain the stability of exchange rates across various segments.

As at the time of this report by Business Post, it was observed that price of the Brent Crude, under which Nigeria’s crude is categorized, was trading close to $64 per barrel, higher than the $60 and $57 benchmark in the 2019 and 2020 budgets respectively.

On the other hand, the external reserves, currently at $39 billion, would need to shed about 30 percent for the government to put in place any corrective measure and this was not the case.

Mr Emefiele’s interactions with investors came after signs of a growing backlog of foreign exchange demand. The central bank recorded a less foreign exchange inflows than outflows in the third quarter of 2019. This would be the third time such would occur in almost four years since the foreign exchange crisis of 2016 and the first time in 2019.

Also, net forex outflow in the third quarter was $3.6 billion, being the difference between inflows of $11.7 billion against outflows of $15.3 billion. This implies that net forex outflows may put pressure on the exchange rate which the CBN, through its interventions, has protected at all costs for more than two years.

Lower dollar inflows reduce the CBN’s capability in defending the Naira against any depreciation as it affects the country’s external reserves.

The CBN’s gross external reserves are already on the decline, after shrinking 12 percent from $45 billion at the start of the year.

Foreign investors have been particularly worried by the trend which surely rekindles bitter memories from 2016 when the foreign exchange backlog swelled to as much as $7 billion as investors could not take out their money.

Kindly contact us @ Naijalivetv@gmail.com

Call or Whatsapp: 07035262029, 07016666694, 08129340000