The Central Bank o Nigeria (CBN) has engaged the Chief Justice of Nigeria (CJN) Justice Ibrahim Tanko Muhammad, on the establishment of a Special Tribunal for the Enforcement and Recovery of Eligible Loans.

The Special Tribunal is one of the provisions of the Banks and Other Financial Institutions Act (BOFIA) 2020.

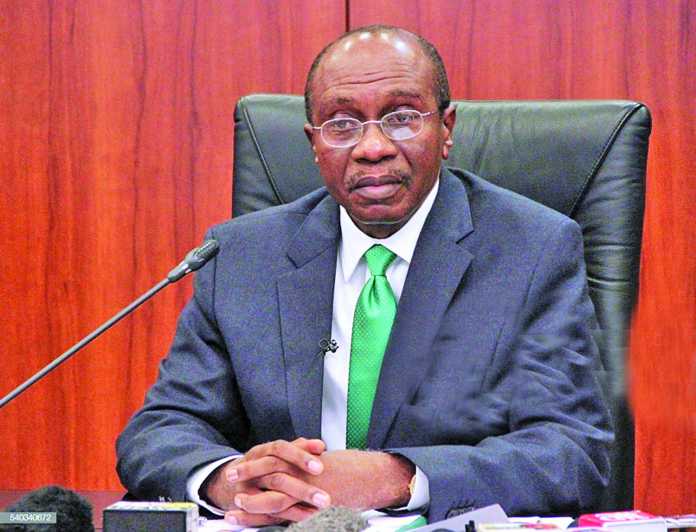

The CBN Governor, Mr. Godwin Emefiele, told the CJN and other senior judicial officers at the Judges Workshop on Recent Reforms of the Banking and Financial Services Sector in Nigeria, in Abuja, yesterday, that the Tribunal was introduced in the Act to accelerate credit recovery processes and enforcement of collateral rights.

READ ALSO: CBN to banks: review loans to oil & gas, agric, other sectors

According to the governor who was represented by the Deputy Governor , in charge of Financial System Stability (FSS), Mrs. Aisha Ahmad, “The Special Tribunal, together with the Bank’s Policy on Global Standing Instruction will address the incidence of non-performing loans that has posed a great threat to the Nigerian financial system.

“Supervisory observance indicates that recalcitrant debtors have exploited the non-prioritization of credit recovery matters in the Nigerian judicial system to frustrate debt recovery efforts by financial institutions.

“The Bank is currently informally engaging the key stakeholders in the judiciary to operationalize this provision.”

The CBN boss said that BOFIA 2020 was expected to reinvigorate the Nigerian banking sector as it would engender a sound and stable financial system that would support sustainable growth and development of the Nigerian economy.

He added that the entire Committee of Governors (COG) of the CBN, recognized the fundamental role of the judiciary in upholding the CBN’s mandate and ensuring the orderly operation of the financial system.

He said, “Your role as custodians of the law, providing certainty of legal rights and the speed of fair and impartial resolution of commercial disputes is critical to building confidence in the banking and financial markets.”

Mr. Emefiele described the Nigerian banking industry as strong and stable, despite occasional shocks.

“The Nigerian banking industry is strong, stable and resilient and continues to experience steady growth. Despite occasional shocks experienced over the last decade, it remains a strong instrument for economic growth and development through granting of credit facilities to the real sector of the economy, critical pass through for monetary policy measures and maintenance of world class innovative payment and settlement services,” he said.

In his address, the CJN re-iterated the age-long view that, “time is money,” and that the financial sector needed speedy resolution of commercial disputes.

According to him, in the normal judicial process, a matter could take between eight to twenty years to reach a final resolution, noting, “no investor will wait for eight to twenty years for a dispute involving his money to be resolved. The winner in the dispute would have had his money depreciated.”

“Cases should be dispensed with quickly,” he said, adding, “timely dispensation of disputes by the judiciary will contribute to financial sector stability in the country.”

In a message, the Attorney-General of the Federation and Minister of Justice, Mr. Abubakar Malami, urged the CBN to take actions against any bank that defrauded its customers.

He said that with the establishment of the Special Tribunals, recovery of loans should be effected with dispatch.

Kindly contact us @ Naijalivetv@gmail.com

Call or Whatsapp: 07035262029, 07016666694, 08129340000